Wolfspeed 宣布 200 mm 碳化硅材料产品组合开启大规模商用,推动行业实现规模化量产

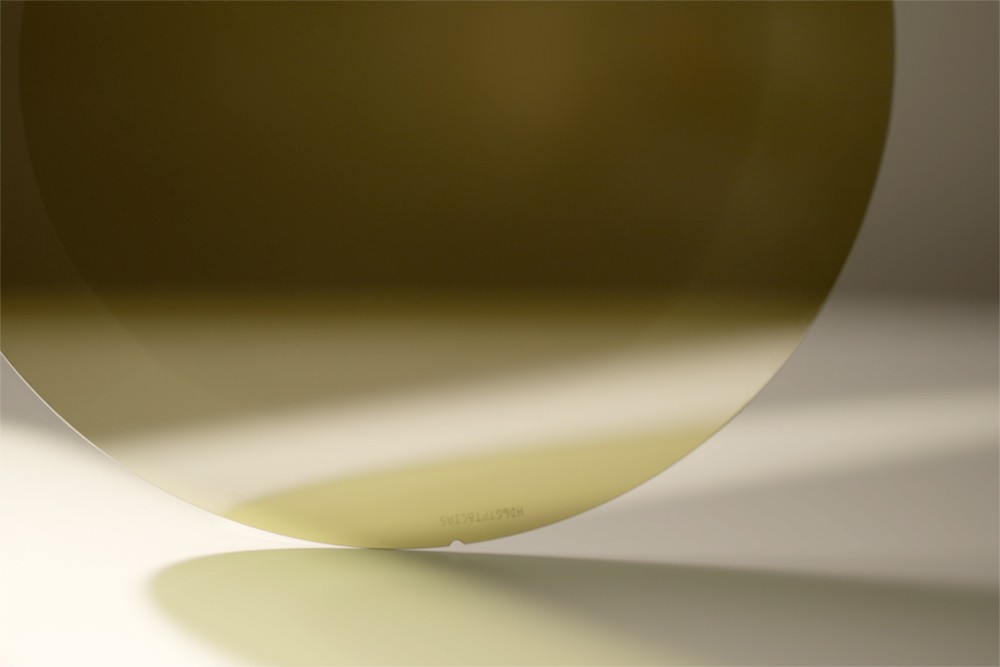

2025 年 9 月 10 日(美国东部时间)美国北卡罗来纳州达勒姆 —— 全球碳化硅 (SiC) 技术引领者 Wolfspeed, Inc. 公司(纽约证券交易所上市代码:WOLF)宣布,Wolfspeed 200 mm 碳化硅材料产品开启大规模商用。这一重要里程碑标志着 Wolfspeed 加速行业从硅向碳化硅转型的使命迈出关键一步。先前在初步向部分客户提供 200 mm 碳化硅产品之后,市场反响积极且效益显著,因此 Wolfspeed 决定开启大规模商用,全面推向市场。Wolfspeed 还同步推出可供即时认证的 200 mm 碳化硅外延片,结合其 200 mm 裸晶圆,能够实现突破性的规模化量产与更为优异的品质,助力下一代高性能功率器件的开发。

Wolfspeed 首席商务官 Cengiz Balkas 博士表示: “Wolfspeed 的 200 mm 碳化硅晶圆不仅是尺寸的扩大,更是一项材料创新,能够帮助客户自信满满地加速其器件技术路线图的推进。通过提供规模化量产且高质量的产品,Wolfspeed 有效助力电力电子制造商满足市场对于更高性能、更高效率碳化硅解决方案日益增长的需求。”

Wolfspeed 200 mm 碳化硅裸晶圆在 350 µm 厚度下实现了更为优异的参数规格,而 200 mm 外延片则具备行业领先且进一步改善的掺杂和厚度均匀性。这些特性使得器件制造商能够提高 MOSFET 良率、缩短产品推向市场的时间,并为汽车、可再生能源、工业及其他高增长应用领域提供更具竞争力的解决方案。同时,Wolfspeed 200 mm 碳化硅在产品与技术方面的进步也将持续正向反馈至 150 mm 碳化硅材料产品。

Wolfspeed 首席商务官 Cengiz Balkas 博士补充道: “这一进步体现了 Wolfspeed 长期以来致力于突破碳化硅材料技术边界的不懈承诺。此次开启 200 mm 碳化硅材料产品组合大规模商用,彰显了我们预见客户需求、随需扩展规模的能力,并为实现更高效率功率转换的未来奠定了材料基�础。”

关于 Wolfspeed 200 mm 碳化硅材料产品组合的更多信息,敬请访问:https://www.wolfspeed.com/products/materials/

关于 Wolfspeed, Inc.

Wolfspeed(纽约证券交易所上市代码:WOLF)在全球范围内推动碳化硅技术采用方面处于市场领先地位,这些碳化硅技术为全球最具颠覆性的创新成果提供了动力支持。作为碳化硅领域的引领者和全球最先进半导体技术的创新者,我们致力于为人人享有的美好世界赋能。Wolfspeed 通过面向各种应用的碳化硅材料、功率模块、分立功率器件和功率裸芯片产品,助您实现梦想,成就非凡(The Power to Make It Real™)。了解更多详情,敬请访问 www.wolfspeed.com。

此新闻稿的中文翻译仅供参考,相关信息请以英文原稿为准。英文原稿链接如下:

https://www.wolfspeed.com/company/news-events/news/wolfspeed-announces-the-commercial-launch-of-200mm-silicon-carbide-materials-portfolio-unlocking-the-industrys-ability-to-manufacture-at-scale/

Forward-Looking Statements

This press release contains forward-looking statements involving risks and uncertainties, both known and unknown, that may cause Wolfspeed’s actual results to differ materially from those indicated in the forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about Wolfspeed’s ability to reduce customer lead times, improve manufacturing quality and efficiency, and achieve growth. Actual results could differ materially due to a number of factors, including but not limited to, ongoing uncertainty in global economic and geopolitical conditions, such as the ongoing military conflict between Russia and Ukraine and the ongoing conflicts in the Middle East; changes in progress on infrastructure development or changes in customer or industrial demand that could negatively affect product demand, including as a result of an economic slowdown or recession, collectability of receivables and other related matters if consumers and businesses defer purchases or payments, or default on payments; risks associated with our expansion plans, including design and construction delays, cost overruns, the timing and amount of government incentives actually received, including, among other things, any direct grants and tax credits, issues in installing and qualifying new equipment and ramping production, poor production process yields and quality control, and potential increases to our restructuring costs; our ability to obtain additional funding, including, among other things, from government funding, public or private equity offerings, or debt financings, on favorable terms and on a timely basis, if at all; our ability to take certain actions with respect to our capital and debt structure; the risk that we do not meet our production commitments to those customers who provide us with capacity reservation deposits or similar payments; the risk that we may experience production difficulties that preclude us from shipping sufficient quantities to meet customer orders or that result in higher production costs, lower yields and lower margins; our ability to lower costs; the risk that our results will suffer if we are unable to balance fluctuations in customer demand and capacity, including bringing on additional capacity on a timely basis to meet customer demand or scaling back our manufacturing expenses or overhead costs quickly enough to correspond to lower than expected demand; the risk that longer manufacturing lead times may cause customers to fulfill their orders with a competitor's products instead; product mix; risks associated with the ramp-up of production of our new products, and our entry into new business channels different from those in which we have historically operated; our ability to convert customer design-ins to design-wins and sales of significant volume, and, if customer design-in activity does result in such sales, when such sales will ultimately occur and what the amount of such sales will be; the risk that the markets for our products will not develop as we expect, including the adoption of our products by electric vehicle manufacturers and the overall adoption of electric vehicles; the risk that the economic and political uncertainty caused by the tariffs imposed or announced by the United States on imported goods, and corresponding tariffs and other retaliatory measures imposed by other countries (including China) in response, may continue to negatively impact demand for our products; the risk that we or our channel partners are not able to develop and expand customer bases and accurately anticipate demand from end customers, including production and product mix, which can result in increased inventory and reduced orders as we experience wide fluctuations in supply and demand; risks related to international sales and purchases; risks resulting from the concentration of our business among few customers, including the risk that customers may reduce or cancel orders or fail to honor purchase commitments; the risk that our investments may experience periods of significant market value and interest rate volatility causing us to recognize fair value losses on our investment; the risk posed by managing an increasingly complex supply chain (including managing the impacts of supply constraints in the semiconductor industry and meeting purchase commitments under take-or-pay arrangements with certain suppliers) that has the ability to supply a sufficient quantity of raw materials, subsystems and finished products with the required specifications and quality; risks relating to outbreaks of infectious diseases or similar public health events, including the risk of disruptions to our operations, supply chain, including our contract manufacturers, or customer demand; the risk we may be required to record a significant charge to earnings if our remaining goodwill or amortizable assets become impaired; risks relating to confidential information theft or misuse, including through cyber-attacks or cyber intrusion; our ability to complete development and commercialization of products under development; the rapid development of new technology and competing products that may impair demand or render our products obsolete; the potential lack of customer acceptance for our products; risks associated with ongoing litigation; the risk that customers do not maintain their favorable perception of our brand and products, resulting in lower demand for our products; the risk that our products fail to perform or fail to meet customer requirements or expectations, resulting in significant additional costs; risks associated with strategic transactions; the risk that we are not able to successfully execute or achieve the potential benefits of our efforts to enhance our value; the substantial doubt about the Company’s ability to continue as a going concern; and other factors discussed in our filings with the Securities and Exchange Commission (SEC), including our report on Form 10-K for the fiscal year ended June 30, 2024, and subsequent reports filed with the SEC. These forward-looking statements represent Wolfspeed's judgment as of the date of this release. Except as required under the United States federal securities laws and the rules and regulations of the SEC, Wolfspeed disclaims any intent or obligation to update any forward-looking statements after the date of this release, whether as a result of new information, future events, developments, changes in assumptions or otherwise.

Wolfspeed® is a registered trademark of Wolfspeed, Inc.

Cautionary Note Regarding the Company's Common Stock

The Company cautions that trading in the Company's common stock during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company's common stock may bear little or no relationship to the actual recovery by holders of the common stock in the Chapter 11 Cases. The Company cannot assure investors of the liquidity of an active trading market, the ability to sell shares of the common stock when desired, or the prices that an investor may obtain for the shares of the common stock.

Contact:

Media Relations:

Bridget Johnson

Head of Corporate Marketing and Communications

847-269-2970

media@wolfspeed.com

Investor Relations:

Tyler Gronbach

VP of External Affairs

919-407-4820

investorrelations@wolfspeed.com